The top 5 AI stocks under US$10 for 2023 provide an excellent starting point for those seeking to acquire AI stocks. These stocks naturally fit tech investments and offer tremendous growth potential.

Some AI stocks are dependent on AI technology. If there are advancements in AI, these stocks will be significantly affected. We know that by the end of 2023, there will be a lot of new advances in AI technology.

Top 5 AI stocks under US$10

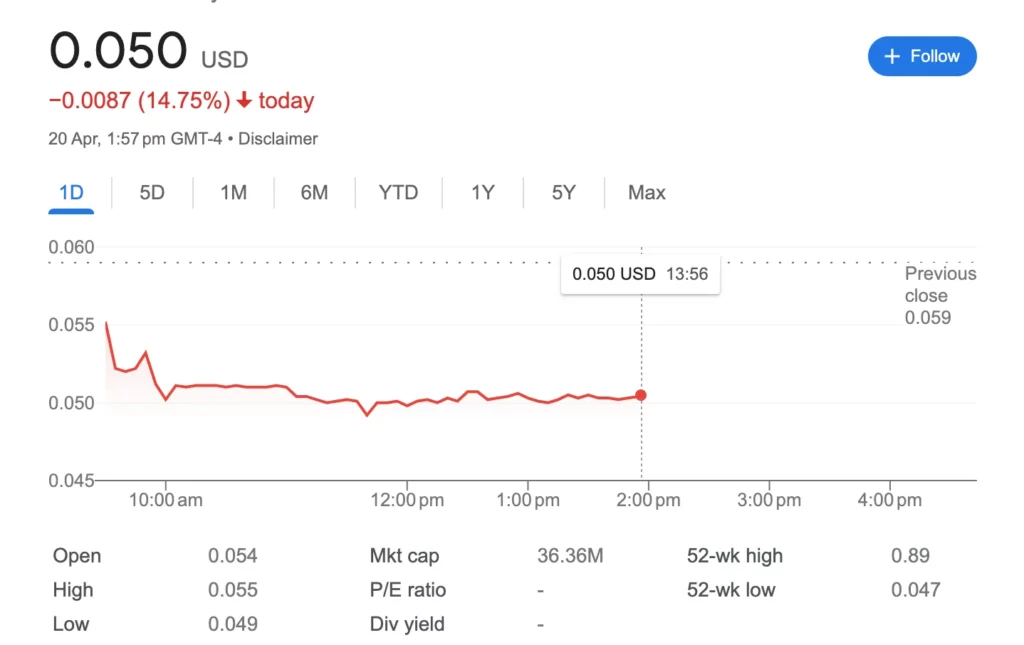

- Ideanomics (IDEX): If you’re looking for penny stocks with the potential for significant growth, Ideanomics is worth considering. This company specializes in Mobile Electric Vehicle Mobility and Fintech Enterprise services, primarily on electrification solutions for commercial truck and bus fleets. This includes everything from infrastructure development and construction to operational support, making it a fascinating investment opportunity.

As of the time of writing, its price is :

Ideanomics is such an exciting company because they’re working in the electric vehicle industry, which could potentially see significant advancements in the coming months. With the implementation of AI, there could be many new advancements in this rapidly growing industry. Electric vehicles are a massive industry, so investing in a company like Ideanomics could be a smart move for the future.

Its price is relatively low now, and we think it will be a considerable gain if it gives us a 20 to 30% gain in the next few months.

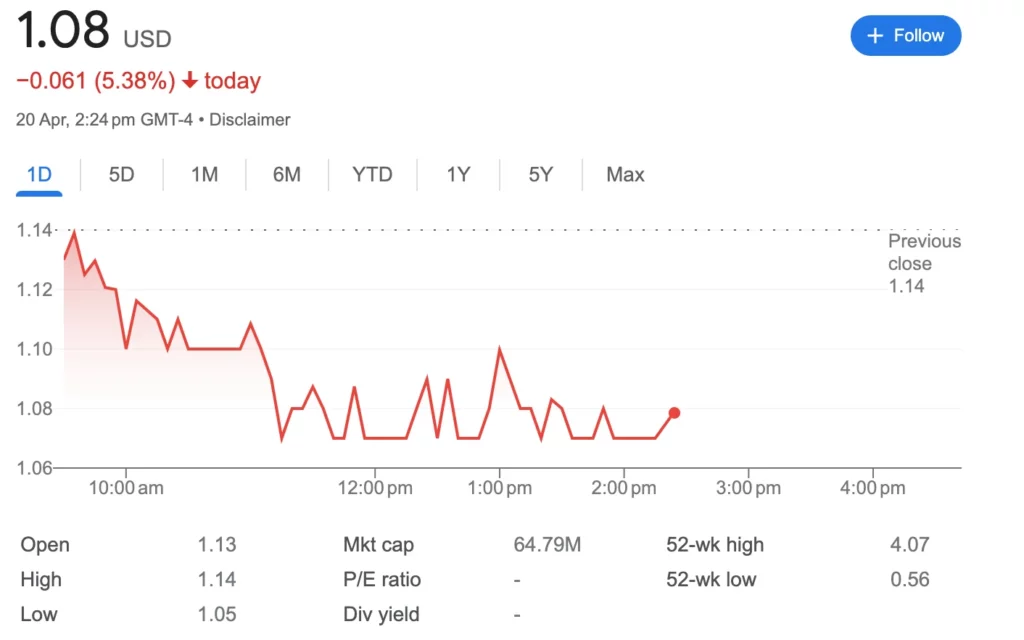

- Rekor Systems (REKR): REKR is leading the way in transforming the management software and data of public transportation systems across the United States. With the acquisition of numerous companies, REKR has expanded its reach and influence in this industry.

We know that transportation is one of the biggest challenges in the United States, and many advancements are being made to address this issue. If AI technology is implemented in the transportation sector in the US, we can expect significant growth for companies like REKR by the end of 2023.

As of the time of writing, its price is :

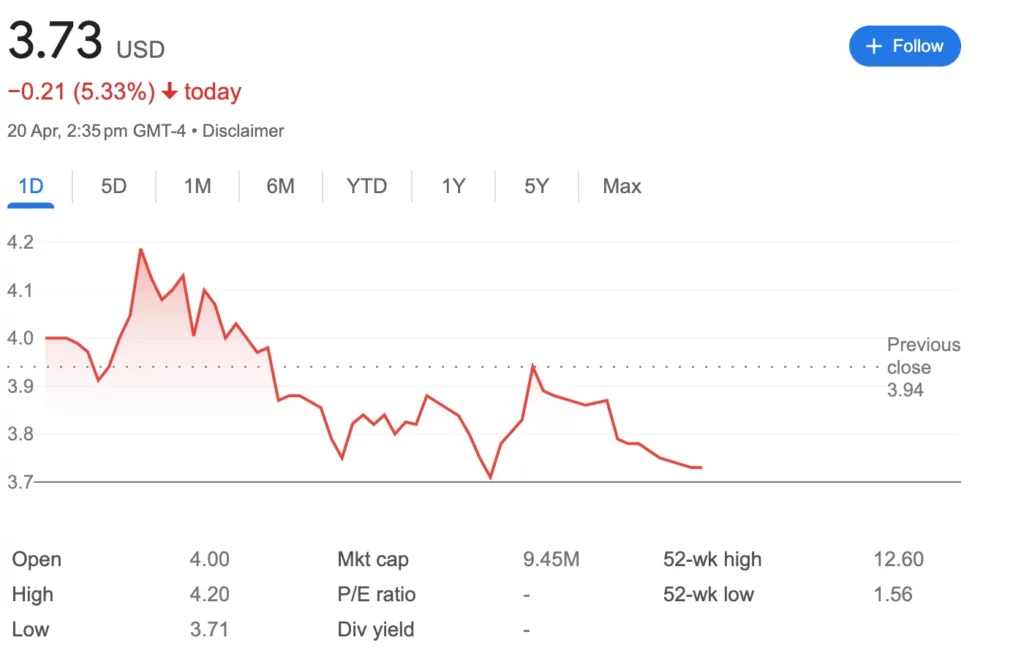

- Amesite INC: While Amesite initially provided services to businesses, the company’s real potential for growth lies in how its corporate partners can utilize the Learning Community Environment AI platform for compliance and staff training. This is where Amesite’s stock can truly shine.

It’s like looking for a mentor if you want to learn something. With the upcoming AI era, finding a mentor or investing in companies like Amesite can be smart as AI technology advances. As AI technology continues to grow, Amesite’s stock has the potential to rise.

As of the time of writing, its price is :

Although the price we discussed earlier may be slightly higher, if we consider the future and invest in Amesite using the DCA (dollar-cost averaging) method, we can ride the price fluctuations and potentially earn a good return on our investment in the future.

- Cootek (Cayman) Inc: The company markets itself as a worldwide mobile internet company, primarily focused on developing products for mobile phones. Utilizing artificial intelligence, it has produced a diverse collection of mobile games that cater to individuals with a fast-paced lifestyle. Additionally, the company offers an online literary product that complements its gaming segment, providing clients with captivating and pertinent information obtained through its own AI engine.

As of the time of writing, its price is :

Artificial intelligence is not only used to create big games but also to produce movies. If we look at this company, it does not necessarily mean that they only focus on games. In the future, there may be many other projects related to artificial intelligence, such as the example of the metaverse. If this company continues to evolve alongside artificial intelligence, its value may increase twofold.

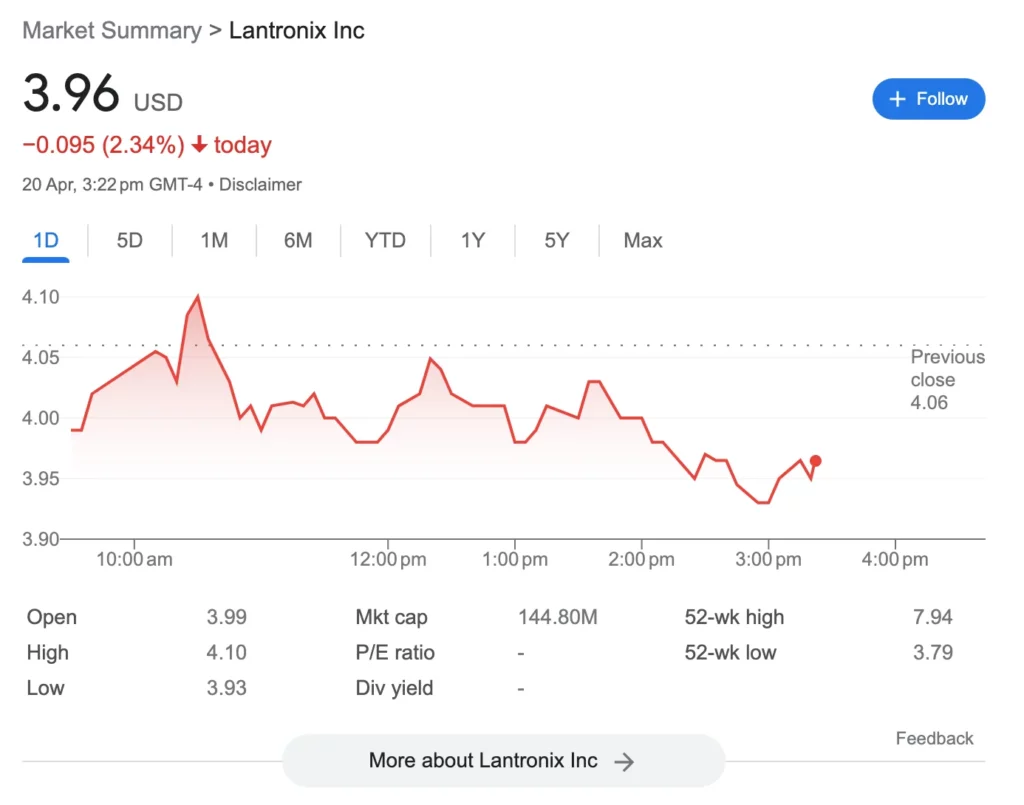

- Lantronix: is a global company that serves clients across various regions, including the Americas, the Middle East, Europe, Africa, the Asia Pacific, and Japan. The company has adopted a three-pronged approach that leverages significant advancements in SaaS, IoT, and AI/ML technologies. Lantronix boasts a wide range of customers from diverse industries, including industrial, financial, energy, healthcare, transportation, security, information technology, and government sectors, making it an attractive choice for businesses seeking versatile products.

As of the time of writing, its price is :

Please note that the stocks mentioned above are not intended as investment advice. They are solely our personal opinions. We recommend conducting thorough research and deciding based on your analysis if you are considering investing.