Anti-Money Laundering using Machine Learning Techniques is becoming increasingly popular in the financial services industry to prevent financial crimes such as money laundering and fraud. The UN estimates that between $800 billion and $2 trillion is laundered annually, prompting financial institutions to increase their investment in Anti-Money Laundering using Machine Learning Techniques.

It is become the number one technology for AML as it can analyze large data sets and predict future behavior based on historical data.

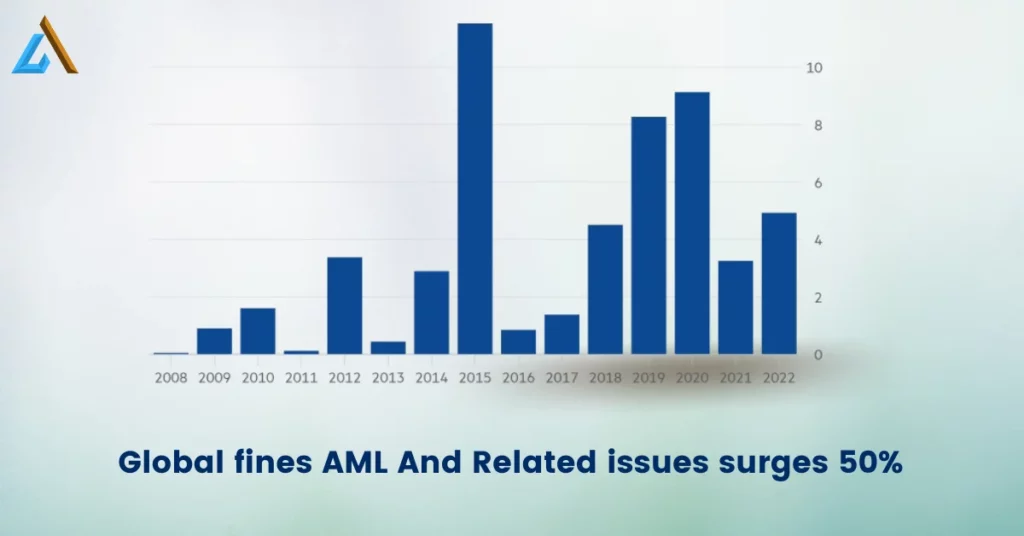

According to a recent report by the Financial Times, global fines imposed for failing to prevent money laundering and other financial crimes rose by over 50% in the previous year. This significant increase in penalties has raised concerns that these fines are not effectively addressing the underlying issues that enable criminal activity within the global financial system.

Despite the increase in liabilities, the current systems and measures are still flawed, allowing criminals to funnel their illicit funds through the financial system quickly. This highlights the need for more effective measures to prevent financial crime and ensure the integrity of the global financial system.

Machine Learning Techniques allows machine learning algorithms to identify behavior patterns that hint at money laundering. By learning from historical data, these algorithms can detect deviant behavior and help AML teams see potential instances of money laundering while reducing the frequency of low-value alerts and allowing analysts to focus on high-value warnings.

Despite the benefits, implementing Machine Learning Techniques in AML should be done with caution, as there can be potential implications on controls, operational processes, and team structure.

However, traditional methods of AML that rely solely on rules have drawbacks, such as producing many false positives and needing to be able to keep up with the constantly evolving strategies of money launderers. In contrast, Anti-Money Laundering using Machine Learning Techniques models are flexible and can adapt continuously, making them an effective solution in the fight against money laundering.

Financial institutions must also deal with the challenges of constantly changing compliance requirements and the risk of penalties for non-compliance. To minimize these risks, it is essential to assess the performance of using Machine Learning Techniques models and ensure that the data sources are appropriately labeled.

In conclusion, using Anti-Money Laundering using Machine Learning Techniques has become essential for financial institutions to combat economic crime efficiently. While there may be challenges in implementation, the benefits of using Anti-Money Laundering using Machine Learning Techniques in AML far outweigh the risks, allowing financial organizations to operate in a highly regulated environment with limited tolerance for error.