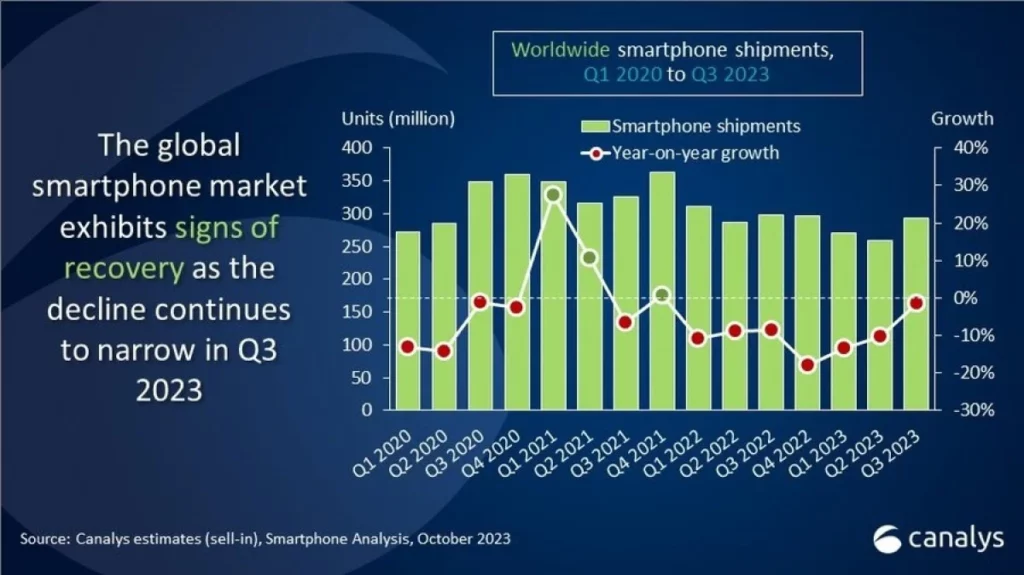

In a world where technology is constantly evolving, the global smartphone market finds itself in a curious state of flux. The latest report from Counterpoint Research indicates that the industry has experienced its ninth consecutive quarter of decline, with a hint of optimism on the horizon.

Let’s delve into the details and break down the most significant insights from this report:

Global Smartphone Market at a Glance

Samsung Holds the Fort

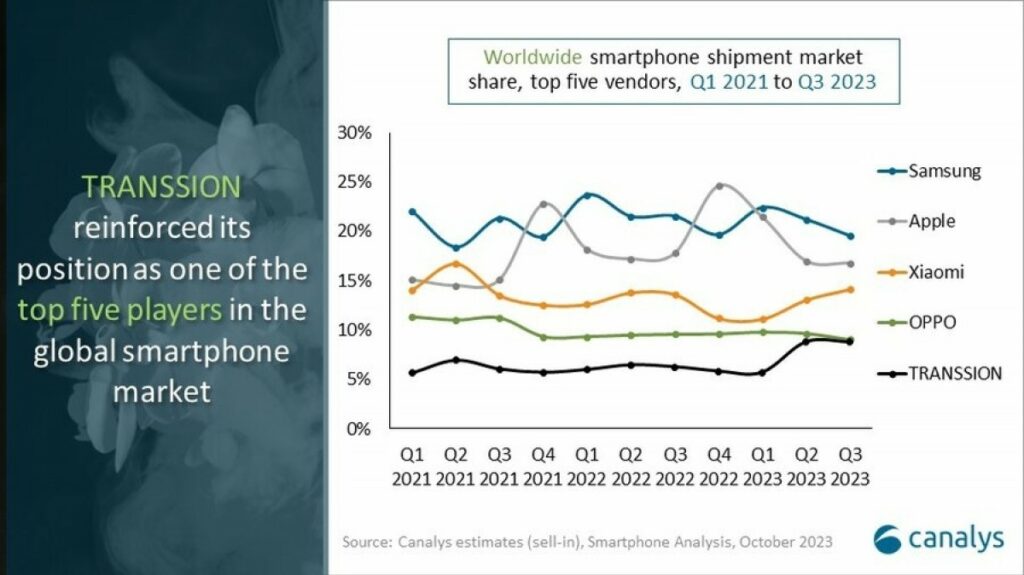

Despite the turbulent market conditions, Samsung has maintained its position as the leader in the global smartphone market, commanding a substantial 20 percent market share. One of the highlights for Samsung has been the reception of their latest foldable phones. The report reveals that the Flip 5 has outsold its counterpart by nearly double, showing that consumers are intrigued by innovative designs.

In the mid-range price segment, Samsung’s A-series models continue to perform admirably, reaffirming the brand’s stronghold in this category.

Apple’s Resilience Amid Challenges

Apple, with a 16 percent market share, secures the second position, even in the face of limited availability of the iPhone 15 series. The loyalty of Apple enthusiasts is evident as they eagerly await the latest releases. Despite a decline of 9 percent, Apple remains a formidable player in the market.

ALSO READ: How to Remove Spyware from Android?

Xiaomi, OPPO, and Vivo:

Xiaomi, OPPO, and Vivo round off the top five, albeit facing year-on-year declines in their shipments. Nevertheless, they are actively strengthening their positions in key markets like China and India while slowing down expansionary efforts in overseas markets.

Emerging Markets Global Slowdown

Emerging markets seem to hold the key to long-term success, with Honor, Huawei, and Transsion Group gaining market share and recording year-on-year growth in Q3. Huawei’s growth can be attributed to the launch of the Mate 60 series in China, while Honor’s overseas performance has been outstanding. Transsion Holdings, which owns brands like itel, Infinix, and Tecno, expanded its presence and benefited from the recovery in the Middle East and Africa (MEA) market, the only region that experienced year-on-year growth in Q3, thanks to improvements in macroeconomic indicators.

| Metric | Data |

|---|---|

| Global Smartphone Shipments | Down 8% YoY |

| Samsung Market Share | 20% |

| Apple Market Share | 16% |

| Xiaomi, OPPO, and Vivo | All recorded YoY declines |

| Huawei’s Comeback | Driven by the Mate 60 series |

| Transsion’s Expansion | Benefiting from MEA’s recovery |

| Regional Performance | North America, Western Europe, South Korea – Declines; MEA – Growth |

| Outlook for Q4 2023 | Positive momentum expected |

| Full-year 2023 Forecast | Market decline, especially in developed markets |

However, it’s not all rosy. Markets in North America, Western Europe, and South Korea have reported steep declines. But here’s where the anticipation for a rebound comes into play. The report suggests that these markets could experience a revival in the fourth quarter, primarily due to the delayed impact of the iPhone launch.

ALSO READ: How To Check if a QR code is safe?

Positive Outlook for Q4 2023

Following a strong September, experts expect the momentum to continue until year-end. The full impact of the iPhone 15 series, coupled with the festive season in India, the 11.11 sales event in China, and Christmas and end-of-year promotions worldwide, are expected to provide the necessary boost. The fourth quarter of 2023 could mark the end of the year-on-year declines, bringing fresh hope to the industry.

Amber Liu emphasizes that Xiaomi and Transsion have capitalized on the rebound in emerging markets. Their short-term gains may pave the way for long-term success, provided they make wise strategic moves.

Toby Zhu, an analyst at Canalys, notes that supply chain cost hikes are expected, and smartphone makers are adapting to the changing situation. The current surge in component orders, combined with reduced supply capacity, may lead to component shortages, posing challenges for planning and production.

In summary, the global smartphone market is navigating through challenging times, but there’s light at the end of the tunnel. While the market may face a full-year decline in 2023, the recovery of emerging markets and the growth of brands outside of the top five indicate a shifting landscape with new opportunities on the horizon. The fourth quarter of 2023 holds the promise of a turnaround, and industry players are gearing up for a fresh start.